By Robin – Your Local Realtor & Neighbor

There’s something special about that first serious thought: Maybe it’s time to buy a house. For many people in Evansville and Janesville, it starts with a feeling—a desire for a place that’s truly yours. Whether you’re tired of renting, planning to start a family, or simply ready to invest in something more permanent, buying your first home is one of life’s biggest (and most rewarding) decisions.

But let’s be honest—it can also be intimidating. Pre-approvals, down payments, inspections, and offers… it’s a lot. And the internet is full of advice that doesn’t always apply to your life here in southern Wisconsin.

That’s why I put this guide together—not just to walk you through the process step by step, but to tailor it to our local market. I’ve helped first-time buyers in both Evansville and Janesville who thought they’d never qualify, didn’t know where to begin, or were overwhelmed by the details. You don’t have to figure it out on your own.

Let’s take it from the top—with what matters most in the beginning: getting financially prepared.

Step 1: Get Your Finances in Shape

Before you even start browsing listings, it’s important to take a good, honest look at your finances. This stage is about clarity and preparation, not perfection.

Buying a home means more than just covering a mortgage. You’ll want to look at: Monthly payment comfort – Factor in principal, interest, taxes, and insurance (PITI). Utilities – In Janesville or Evansville, expect $150–$250/month for average usage. Maintenance – Budget at least 1% of the home’s value each year. Extras – Lawn equipment, furniture, snow removal… the little things add up.

Start with Your Budget

Buying a home means more than just covering a mortgage. You’ll want to look at:

- Monthly payment comfort – Factor in principal, interest, taxes, and insurance (PITI).

- Utilities – In Janesville or Evansville, expect $150–$250/month for average usage.

- Maintenance – Budget at least 1% of the home’s value each year.

- Extras – Lawn equipment, furniture, snow removal… the little things add up.

If you’re not sure what’s realistic, a local lender or I can walk you through what your money gets you in this market. You’d be surprised how many people qualify for more than they expected—or find a great home well within reach.

Check Your Credit

In most cases, a score of 620 or above is required for a conventional mortgage, though FHA loans can allow for scores as low as 580 with a solid down payment. It’s okay if you’re not there yet—credit can often be improved within a few months with the right guidance.

Check for errors and pay down small balances where possible. While you’re in the buying process, avoid taking on any more debt.

Start Saving

You’ll need to plan for:

- Down payment – Typically 3% to 5% for first-time buyers (or 0% with VA/USDA).

- Closing costs – Usually 2–4% of the home price.

- Earnest money – A deposit to show serious interest, often $1,000–$3,000 locally.

You don’t have to save 20%—that’s one of the biggest myths I hear. There are plenty of first-time buyer programs with lower down payments and even assistance options available right here in Wisconsin.

Step 2: Understand Your Loan Options

Once you’ve taken a clear look at your budget, the next step in preparing your home purchase is understanding what kind of mortgage works best for you.

First-time homebuyers in Wisconsin—and especially in communities like Evansville and Janesville—have access to multiple affordable loan programs, many designed to reduce the upfront cost of buying a home.

This isn’t just about picking the lowest rate. It’s about choosing a loan that fits your finances and the home you’re hoping to buy. Here’s a breakdown of the most common and helpful loan options available for first-time buyers in Wisconsin:

WHEDA Loans (Wisconsin Housing and Economic Development Authority)

WHEDA loans are best for first-time buyers needing down payment assistance and competitive interest rates

WHEDA is a Wisconsin-specific program designed to help working families become homeowners. Many of my clients in Evansville and Janesville qualify for WHEDA financing and are surprised at how much support is available.

Benefits include:

- Low down payments (as little as 3%)

- Down payment assistance available as a separate 0% interest loan

- Fixed-rate mortgages only—no surprises

- Lower private mortgage insurance (PMI) costs

To qualify, you typically need:

- A credit score of 620 or higher

- Moderate income (there are local income caps)

- Completion of a homebuyer education course (online options available)

WHEDA is one of my favorite programs to help buyers unlock affordability without jumping through hoops. If you live and work in Wisconsin, this was built for you.

FHA Loans (Federal Housing Administration)

Best for: Buyers with lower credit scores or minimal savings

FHA loans are one of the most flexible loan options available, and many first-time buyers in our area use them.

Key benefits:

- Down payments as low as 3.5%

- Accepts credit scores as low as 580

- Allows higher debt-to-income ratios

Just keep in mind that FHA loans require mortgage insurance for the life of the loan. The home must also meet certain condition standards (no major repairs needed).

USDA Loans

USDA loans are designed for rural buyers looking for zero down payment options

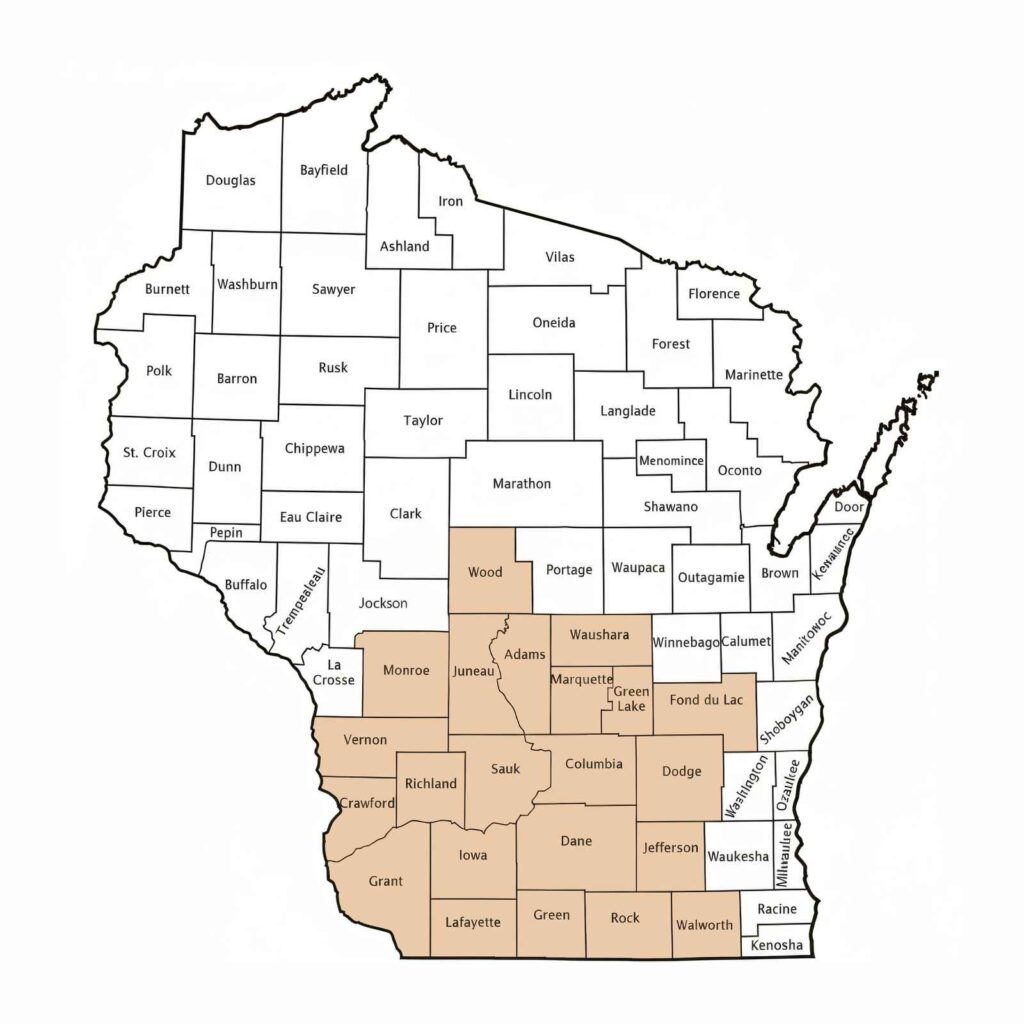

Many areas near Evansville qualify for USDA loans, including some outlying neighborhoods. These loans are backed by the U.S. Department of Agriculture and are designed to support homeownership in rural areas.

Highlights:

- 0% down payment required

- Lower mortgage insurance rates than FHA

- Income limits apply

You might be surprised how many homes in Rock County meet the “rural” requirement—even just 10 minutes outside town.

VA Loans

VA Loans are a bit more select. These are suited to eligible veterans and active service members

If you’ve served in the military, a VA loan is often the most affordable option. No down payment, no PMI, and great rates make this a fantastic benefit for those who qualify.

Each of these programs has its pros and cons, but I can walk you through which options are available based on your income, credit, and goals.

Step 3: Explore Local Assistance Programs

One of the most overlooked steps in preparing your home purchase is finding out what kind of help might be available to you. As a first-time buyer in southern Wisconsin, you might qualify for programs that reduce your out-of-pocket costs—sometimes by thousands of dollars.

And I don’t just mean federal aid. Right here in Evansville and Janesville, there are local organizations and city-backed resources designed specifically to support buyers like you.

So what’s on offer?

Janesville Home Buyer Assistance Program

This is the best option for first-time buyers purchasing a home within Janesville city limits

The City of Janesville offers a down payment and closing cost assistance program for income-qualified buyers. The assistance comes in the form of a 0% interest, deferred-payment loan (meaning you don’t make payments unless you sell, refinance, or no longer live in the home).

Key features:

- Up to $10,000 in assistance

- Must be used toward down payment or closing costs

- Buyer must complete a homebuyer education course

- Household income must fall within HUD income limits for Rock County

This is a fantastic program if you’re buying in Janesville and meet the income guidelines. I’ve seen it make the difference between ‘almost’ and ‘we got the house!’ more than once.”

You can apply through the City of Janesville Neighborhood and Community Services division.

NeighborWorks Blackhawk Region

Best for: Buyers in Evansville, Janesville, and surrounding Rock County

NeighborWorks is a nonprofit housing organization that works across southern Wisconsin. They offer one-on-one counseling, financial planning support, and often administer down payment assistance funds tied to grant cycles.

Services include:

- Credit and budget counseling

- Homebuyer education (required for many assistance programs)

- Matched savings programs or forgivable loans (when available)

Even if you don’t qualify for financial help today, they can help you create a plan to get there.

Combine Assistance with WHEDA

Programs like these can often be stacked with WHEDA loans, giving you the benefit of a great mortgage product plus help with upfront costs. This can dramatically reduce how much you need to bring to the table when making an offer.

What to Keep in Mind

Each program has its own:

- Income limits

- Location boundaries

- Application timeline

- Education requirements

That’s where a local guide (that’s me) comes in handy. I’ll help you figure out what fits, what’s available now, and how to pull everything together without getting lost in paperwork.

Step 4: Start the Search

Now for the fun part—actually looking at homes. Whether you’ve been scrolling Zillow for months or you’re just starting out, the moment you step into a house and think, “This could be it,” is exciting—and sometimes a little overwhelming.

Here’s how to go through this process with confidence and clarity.

What to Expect in a First-Time Buyer Search

In Evansville and Janesville, homes for first-time buyers often fall into that sweet spot between $180,000 and $300,000. In today’s market, homes at this price point can move quickly—sometimes within a matter of days. That’s why preparation (financial and emotional) matters so much.

Once you’re pre-approved and know your budget, we’ll work together to:

- Identify must-haves vs. nice-to-haves

- Watch for fresh listings (I often know what’s coming before it hits the market)

- Schedule showings and answer your questions in real time

Be ready to act—but not to rush. If you’ve done your prep work, you’ll be able to move quickly when it feels right, not out of pressure.

Choosing the Right Neighborhood

Each community has its own feel.

- Evansville: Small-town charm, walkable downtown, strong school pride, and lots of well-kept historic homes.

- Janesville: More selection and amenities, newer subdivisions, a vibrant riverfront district, and easy access to Madison or Beloit.

Think about commute times, school districts (even if you don’t have kids—it affects resale), and proximity to grocery stores and parks.

Making a Strong Offer

When you find a home you love, we move quickly to write an offer. Here’s what that includes:

- Offer price: Based on market data and recent comparable sales

- Earnest money: Typically $1,000–$3,000 in our area, showing you’re serious

- Contingencies: Standard protections like home inspection, appraisal, and financing

- Closing timeline: Usually 30–45 days from accepted offer

I’ll guide you through every detail so you understand exactly what you’re offering—and how to protect yourself. In competitive situations, there are smart ways to stand out without overpaying or waiving important protections.

Step 5: From Offer to Closing — What Happens Next?

Your offer’s been accepted—congratulations! This is a huge milestone, and one that deserves a deep breath and maybe a happy dance. But it’s not quite time to pop the champagne just yet. There are still a few key steps between offer accepted and keys in hand.

Here’s what to expect—and how I’ll help guide you through it.

Home Inspection

Once your offer is accepted, the first major step is the home inspection. You’ll hire a licensed inspector to thoroughly evaluate the property—from the roof to the foundation and everything in between.

This usually happens within 5–10 days of acceptance and is your chance to learn what you’re really buying.

They’ll look at:

- Roof, windows, siding, and structure

- Plumbing and electrical systems

- HVAC systems

- Appliances, insulation, drainage, and more

You’ll receive a full report afterward.

Negotiations (If Needed)

If the inspector finds issues—you’ll have the opportunity to renegotiate. That could mean asking the seller to make repairs, reduce the price, or offer a closing credit.

Not every issue is a dealbreaker, but the inspection gives you leverage and clarity. I’ll help you prioritize what’s worth addressing and what might just be part of owning a home.

Appraisal and Final Mortgage Approval

If you’re financing your purchase, your lender will order an appraisal to confirm the home’s value. This protects you and the bank from overpaying.

Meanwhile, your loan will move through underwriting, where all your financial documents are double-checked. This part can feel tedious, but it’s normal—stay responsive and organized, and it’ll move smoothly.

Closing Day

About a week before closing, you’ll receive a Closing Disclosure showing exactly what you’ll owe, what your loan looks like, and how every penny breaks down.

Then, usually within 30 to 45 days of your accepted offer, you’ll:

- Do a final walk-through to ensure the home is in the same condition

- Sign your documents (it takes about an hour)

- Receive your keys—and officially become a homeowner

It’s completely normal to feel nervous right before closing. But it’s not long now until victory.

Step 6: What to Expect After Move-In

You’ve signed the papers and you’re officially a homeowner. That first night in your new place will likely feel a little surreal. Enjoy it. You earned it.

But what comes next?

Here’s what to expect in the first year—and how to take smart, steady steps as you settle into life as a homeowner in Evansville or Janesville.

Tackle the First Few Tasks

Before you get too cozy, there are a few things you’ll want to handle early:

- Change the locks (or rekey them) for peace of mind

- Update your address with the DMV, banks, and subscriptions

- Check smoke detectors and replace any aging batterie

- Get familiar with your home systems: shut-off valves, circuit breakers, HVAC filters

I always recommend keeping a binder or digital folder with your inspection report, warranties, appliance manuals, and any contractor info in one place. It makes future maintenance much easier.

Budget for Ownership

Owning a home brings new financial responsibilities, but nothing you can’t handle—especially with a little planning.

- Maintenance: Set aside 1–2% of your home’s value per year for repairs and upkeep

- Utilities: Track monthly averages, especially through your first winter

- Emergency fund: Even just $500–$1,000 set aside can soften any surprises

One of the biggest mindset shifts from renting to owning is that you’re now in charge of everything—and that’s a good thing. You get to make changes, build equity, and really make the space yours.

Stay Connected

One of the things I love most about Evansville and Janesville is the sense of community. Whether you’re attending your first city market or cheering at a local football game, you’ll quickly find your rhythm here.

If you’re new to town, I’m always happy to connect you with trusted local pros—plumbers, painters, handypeople—so you feel supported right from the start.

And hey, just because the sale is done doesn’t mean I disappear.

I’m here long after closing day. If a question comes up—whether it’s about home repairs, refinancing, or what your home’s worth a few years from now—reach out. I’m always happy to help.

Let’s Make It Happen

Buying your first home can be emotional, exhilarating, and yes—at times—confusing. But you don’t have to go it alone. With the right guide, the process becomes clearer, more confident, and even fun.

If you’re just starting to think about buying, or you’re ready to get pre-approved and start touring, I’d be honored to help you take that first step.

Just reach out, and let’s turn “maybe someday” into “we did it.”

Warmly,

Robin

Your Realtor & Wisconsin Neighbor